Debt Review

Debt Review, is a debt solution targeted at South African consumers who are over indebted and struggling to manage their financial obligations.

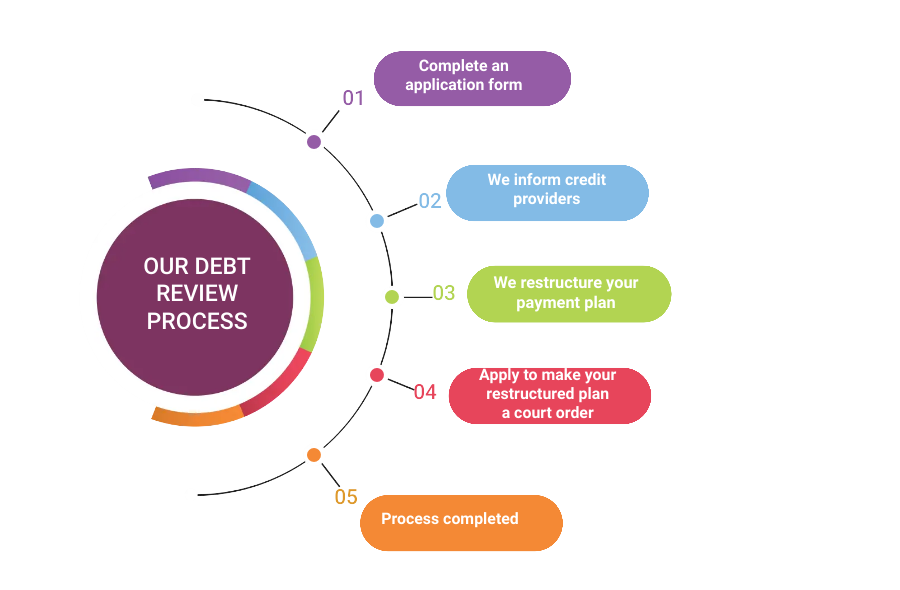

Debt Review is the process whereby a debt counsellor assesses a consumers outstanding debt and implements a restructured debt repayment plan. This will be done through the process of renegotiating interest rates with credit providers in order to reduce them, as well as by extending the debt repayment terms. A new affordable monthly budget and payment plan will be drawn up by a debt counsellor. The consumer is the required to pay inline with the new payment arrangement.The process is then finalised with the granting of a debt review court order. Yor debt counsellor will then issue a clearance certificate, once you have settled all your debts.

Credit providers cannot take legal action against you if you go under debt review. This means that aside from the protection of your assets, you will also end up paying less for your debt on a monthly basis. All fees will be included in your reduced monthly payment.

In addition to this, the debt review process entails that the consumer only makes only one affordable monthly debt repayment. The payments are then made via the Payment Distribution Agency (PDA), which will then pay all the consumers credit providers. This reduces the stress of having to keep up to date and on top of multiple debt repayments.

DATA ANALYTICS

Our own in house tracing facility, making Virtual application and Assistance with Data Protection and Security.

BUSINESS STRATEGY

KDM ensures that its customers and clients needs are fully compliant and in accordance with the latest NCR rules & regulation. If you are over-indebted and falling behind with your debt repayments, debt review can protect your assets by arranging a structured, affordable repayment plan for your outstanding debt.